Our free App includes the most comprehensive rebate calculator on the market.

With the ability to include PAYE, CIS, Self-employment and Covid Grants and receive an accurate calculation in an instant.

The native in-App experience helps to complete the calculation in a moment. The only thing left to worry about it, is what to spend it on!

Download our App now to get started.

Our App features a live progress tracker for your tax return. Our App is always up to date and reflects the live status of your tax return.

So, if it’s 2 am on April the 6th, and you are waiting for HMRC to issue your rebate, this is the place to check!

The volume of information needed to complete your tax return can be overwhelming at times, so we’ve stripped it down.

Each time there is an update our App will deliver a simple notification.

For most updates, the App notification is probably enough information.

However, you will find more details in the accompanying message.

Did you receive our post?

In most cases a simple tap to confirm is all we need.

The number of platforms and devices that can be used to deliver messages can often lead to communication becoming fragmented across many different areas.

Our App combats this by delivering all the vital messages required to complete your tax return through one centralised system.

This means everything you ever need from us is in one place, regardless of the device, phone number or platform you choose to use.

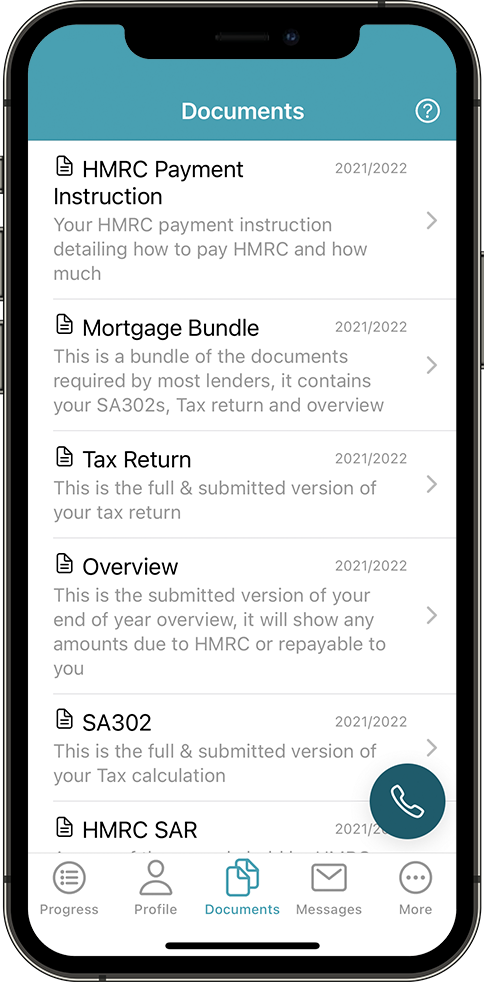

Here you will find all your business records, including copies of any records you provide to us.

The requirement to provide three years of turnovers at once during the COVID SEISS grant applications made us rethink how we store and deliver your records.

This is our solution.

Everything you may ever need, whether it’s tax returns or SA302’s.

All securely stored and freely accessible at your convenience.